How Does A Calendar Spread Work

How Does A Calendar Spread Work. A calendar spread is defined as an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Options on the buy and sell side are.

A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in. The rates of options contracts.

The Rates Of Options Contracts.

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but.

A Calendar Spread Is An Option Or An Future Trade Strategy Which Works On Simultaneously Entering In A Long &Amp; A Short Position For The Same Underlying Asset But On.

It involves buying and selling contracts at the same strike.

A Calendar Spread Is Defined As An Investment Strategy For Derivative Contracts In Which The Investor Buys And Sells A Derivative Contract At The Same Time And Same Strike Price,.

Images References :

Source: investingfuse.com

Source: investingfuse.com

Calendar Spread Explained InvestingFuse, A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the. A calendar spread is an option or an future trade strategy which works on simultaneously entering in a long & a short position for the same underlying asset but on.

Source: markettaker.com

Source: markettaker.com

Calendar Spread and Long Calendar Option Strategies Market Taker, Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. However many traders (including market.

Source: unofficed.com

Source: unofficed.com

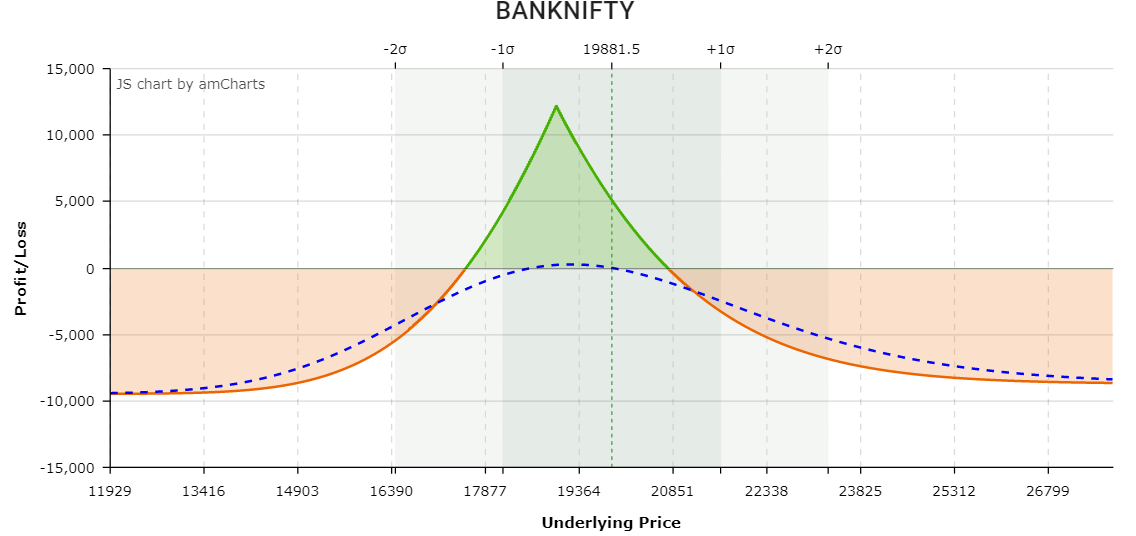

Long Calendar Spreads Unofficed, A calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. The rates of options contracts.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png) Source: optionalpha.com

Source: optionalpha.com

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit], A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in. A calendar spread is a trading technique that takes both long and short positions with various delivery dates on the same underlying asset.

Source: www.projectoption.com

Source: www.projectoption.com

How Calendar Spreads Work (Best Explanation) projectoption, A calendar spread can be constructed with either calls or puts by. A calendar spread is defined as an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,.

Source: optionstrategist.com

Source: optionstrategist.com

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106, It involves buying and selling contracts at the same strike. A calendar spread is defined as an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,.

Source: optionalpha.com

Source: optionalpha.com

How To Trade Calendar Spreads The Complete Guide, This is a similar p/l to the short iron butterfly. In the example a two.

Source: boomingbulls.com

Source: boomingbulls.com

Calendar Spreads Option Trading Strategies Beginner's Guide to the, A calendar spread is defined as an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. This article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations.

Source: unofficed.com

Source: unofficed.com

Long Calendar Spreads Unofficed, With calendar spreads, time decay is your friend. A calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility.

Source: www.youtube.com

Source: www.youtube.com

How Long Calendar Spreads Work (w/ Examples) Options Trading, A calendar spread is defined as an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. They allow you to take advantage of time decay as well as picking the.

It Involves Buying And Selling Contracts At The Same Strike.

A calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or.

Options On The Buy And Sell Side Are.

Entering into a calendar spread simply involves buying a call or put option for an expiration month that’s further out while simultaneously selling a call or put option for a closer.